Increasing Number of Bitcoin Whales According to Data

Investor confidence in Bitcoin is growing, as reflected in the rising number of active addresses and whale wallets. This trend indicates overall market growth, as Bitcoin’s recent price performance and its ability to overcome past challenges have bolstered investor trust. While this might sound like a marketing slogan, the significant rise in new "whale wallets" – large investors accumulating Bitcoin – clearly demonstrates optimism about Bitcoin’s growth potential. Ki Young Ju, CEO of CryptoQuant, recently highlighted this in a post, noting the substantial increase in the number of whale wallets rapidly accumulating BTC.

Rising Activity Could Signal a Market Shift

The surge in whale activity is viewed as a positive sign for Bitcoin's future. According to analysts, these large investors are taking advantage of Bitcoin’s current consolidation phase, amassing more coins in anticipation of future gains. Young Ju reported that the total balance in these whale wallets now stands at approximately 1.97 million BTC, representing an impressive 813% increase compared to last year. These new whale wallets collectively hold around 9.3% of the total Bitcoin supply, valued at roughly $132 billion. This accumulation is comparable to investors increasing their stake in a company they trust. It’s important to note that the increase in the number of large wallets does not include exchanges or miners. Typically, these wallets hold more than 1,000 BTC each, and the average coin age in these wallets is around 155 days, suggesting these are relatively new coins, likely part of custodial services.

A Sign of Growing Optimism

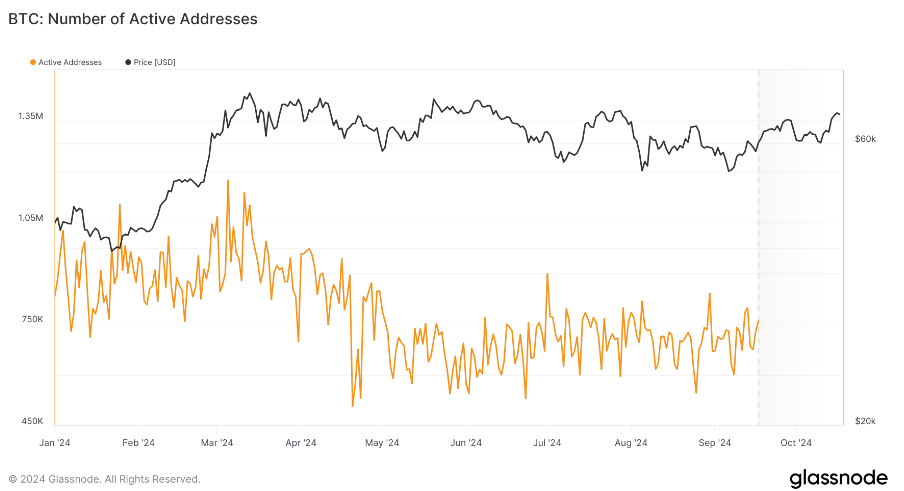

Although the data may not be 100% reliable, the optimism among large investors is evident. Simultaneously, the number of active BTC addresses has risen sharply, reflecting greater interest and activity from investors in the crypto space. This increase in activity follows the price dip in July and August, during which the number of active addresses declined. The current growth in active addresses has surpassed both the monthly and yearly averages, indicating improved user engagement. Historically, such a rise in user participation has been one of the key indicators of a bull market cycle, suggesting that the network may be on the verge of a market shift.